Baby Step 6.0: Pay off house EARLY NOTE: Making 1 extra payment per year (or 1/12th of a payment extra each month) will reduce the number of payments on a 30 year mortgage by 4 years or more. Our future plan: Stay tuned, the next and last Baby Step is the best… Previous Posts: Coming Up Next:

Dave Ramsey's Baby Steps - Expanded

Baby Step 0: Live like no one else…

Baby Step 1.0: Save $1,000 in Baby Emergency Fund (BEF)

Baby Step 2.0: Do debt snowball, paying all your debts from lowest BALANCE to highest

Baby Step 3.0: Save 3-6 months EXPENSES in a Fully Funded Emergency Fund (FFEF)

Baby Step 4.0: Start Contributing 15% of you paycheck to retirement

Baby Step 5.0: Save for kids college fund

Baby Step 7.0: Build Wealth & Give - … so now you can live like no one else!!

Dave Ramsey's Expanded Baby Steps - Baby Step 6.0

Posted by Lance | 6:02 AM | Baby Steps, Dave Ramsey, Personal finance | 0 comments »Cut the cable on Cable TV?

Posted by Lance | 9:14 AM | Financial Action, Personal finance, save money | 0 comments » Image via Wikipedia

Image via Wikipedia

What about your cable bill?

We have cut out all but basic cable and I have ordered a HDTV tuner so that I can get FREE over the air HDTV. Once I get that all set up, we may cut the cable to cable tv all together (pun intended).

Checkout this article detailing what one couple has done to save $1488 over 16 months.

ABC News: Cancel Your Cable and Still Watch Great TV

Posted using ShareThis

Dave Ramsey's Expanded Baby Steps - Baby Step 5.0

Posted by Lance | 6:31 AM | Dave Ramsey, Financial Action, Personal finance | 0 comments »Baby Step 5.0: Save for kids college fund

NOTE: There are 3 common college savings avenues

- Education IRA or Education Savings Account

- UTMA or UGMA (Universal Transfer/Gift to Minors Act)

- State Sponsored 529 Plan

Our plan:

- Once the second mortgage is paid off, then we can start retirement back and begin our college fund.

- Right now we have some money sitting in an ING account designated for our son. I actually haven’t made up my mind yet exactly which avenue we will use for the college fund. Considering using a Roth IRA in my wife’s name, that way it’s not tied solely to education and then if they don’t need or use it, it’s just extra retirement funds for us.

Another note on steps 4.0 and 5.0, they are typically done at the same time.

Previous Posts:

Dave Ramsey’s Baby Steps - Expanded

Baby Step 0: Live like no one else…

Baby Step 1.0: Save $1,000 in Baby Emergency Fund (BEF)

Baby Step 2.0: Do debt snowball, paying all your debts from lowest BALANCE to highest

Baby Step 3.0: Save 3-6 months EXPENSES in a Fully Funded Emergency Fund (FFEF)

Baby Step 4.0: Start Contributing 15% of you paycheck to retirement

Coming Up Next:

Baby Step 6.0: Pay off house EARLY

Credit Card Compromise - May Be Largest Ever!!

Posted by Lance | 4:07 PM | Personal finance | 0 comments »

In case you missed this because it was buried under all the inauguration day hype, the credit card processing company Heartland Payment Systems exposed millions of credit card numbers over a number of months. These were Visa and MasterCard transactions. They didn’t even know about the breach until Visa and MasterCard notified them, and that was LAST YEAR! See articles here and here.

Our local credit union has a actual list (that is continuing to be updated) of the card numbers that were compromised. All I had to do was make a phone call and at this point our debit cards are in the clear. They suggested call again in another week or so just to re-verify.

I also called ING to check on our Electric Orange debit cards. The initial CS rep didn’t have a clue what I was talking about, so she put me on hold and after talking with the fraud department, she said that they had reviewed the accounts and no debit cards were compromised and they were not issuing new cards based on this breach. Very friendly and efficient.

If don’t have an ING account, consider opening one, and if you want a $25 bonus (with $250 deposit) let me know and I’ll get you a referral link.

Dave Ramsey's Expanded Baby Steps - Baby Step 4.0

Posted by Lance | 6:44 PM | 401(k), Dave Ramsey, Financial Action, Personal finance, Roth IRA | 0 comments »Baby Step 4.0: Start contributing 15% of your paycheck to retirement

Image via Wikipedia4.1 First fund employer 401K plan up to the match.

Image via Wikipedia4.1 First fund employer 401K plan up to the match.

4.2 Remainder into Roth IRA, up to contribution limit.

4.3 If Roth IRA is maxed out, go back to the 401K or a standard IRA.

NOTE: Invest in 4 type of mutual funds

· Growth & Income (Large Cap Fund) 25%

· Growth (Mid Cap or Equity Fund) 25%

· Aggressive Growth (Small Cap or Emerging Market Fund) 25%

· International 25%

Here are the personal steps we plan to take when we are ready to continue on this journey:

1. We have followed Dave’s plan and stopped contributing to our retirement for now, until we have paid off the second mortgage on the house. Then we will be debt free except the house and ready to tackle Baby Step 4.

2. My employer does not match any contributions into the 401K. My wife only works part time so therefore doesn’t have a 401K plan. So we jump straight to step 4.2.

3. Maxing out the Roth IRA will get us most of the way to putting 15% in to retirement. If our finances improve, which of course would be nice, we will go to the 401K to take advantage of the tax benefits.

Previous Posts:

Dave Ramsey’s Baby Steps - Expanded

Baby Step 0: Live like no one else…

Baby Step 1.0: Save $1,000 in Baby Emergency Fund (BEF)

Baby Step 2.0: Do debt snowball, paying all your debts from lowest BALANCE to highest

Baby Step 3.0: Save 3-6 months EXPENSES in a Fully Funded Emergency Fund (FFEF)

Coming Up Next:

Baby Step 5.0: Save for kids college fund

OBAMA: We will reverse our dependence on foreign oil…

Posted by Lance | 11:06 AM | Energy conservation, Stimulus | 0 comments » Image by Getty Images via Daylife

Image by Getty Images via Daylife

From this morning’s talk from Obama in the East Room of the Whitehouse

1. Energy Economy

a. Clean energy investments

b. 75% of federal building more efficient

2. Fuel Efficient Cars built in America

a. DOT to set standard for year 2011 set by March

b. 35 mpg by 2020

3. Reduce Greenhouse Gas Emissions

a. Work with, not against states

b. Direct the EPA to reconsider requests by California

c. Incentives for developing new energy

4. Global Coalition

a. Time for America to lead

b. America will not be held hostage

LRG: And these things are going to stimulate the economy?

Don't miss anything, subscribe:

Some Retail Shopping Advice in 2009

Posted by Lance | 9:30 AM | iPod Touch, Retail Shopping | 0 comments »I was reading an article from The Wisdom Journal called Retailers Biting The Dust - where you WON’T be shopping in 2009.

That article lists several retailers that could be closing their doors in 2009. It also goes on further to say that “if you’re holding a gift card from one of these retailers, it might be a good idea to go ahead and use it now.”

I was discussing this with family over the weekend when I was reading this on my iPod Touch and my impression was that they thought this was a lot of doom and gloom. Like maybe they didn’t quite think that this list was a real possibility. We here’s some more evidence released this morning that supports at least one of those companies inclusion on the list.

Sprint Nextel Plans to Cut 8,000 Jobs in Quarter

By THE ASSOCIATED PRESS

Published: January 27, 2009

The job cuts at the wireless provider, which represent about 14 percent of its work force, are aimed at cutting annual costs by $1.2 billion.

Dave Ramsey's Expanded Baby Steps - Baby Step 3.0

Posted by Lance | 6:03 AM | Dave Ramsey, Financial Action, Personal finance | 0 comments »Baby Step 3.0: Save 3-6 months EXPENSES in a Fully Funded Emergency Fund (FFEF)

3.1 Start car replacement fund.

3.2 Save 20% for home purchase OR pay down existing mortgage to the point you can drop PMI.

3.3 Start furniture or other non-essential stuff replacement fund.

3.4 Move up in car if you still feel the need to (must pay cash for it)

Here are the personal steps we have taken so far as we continue on this journey:

1. In order to provide extra security for the wife, we have almost 2 months already in our EF.

2. We have already purchased a home and we have about 40% equity as of right now, never had PMI.

3. We have started various replacement and non-essential type funds that we contribute to monthly. We did start this with the first budget for 2009, before finishing step 2, as a personal preference because the pay off of the second mortgage is within reach, only a few months from now.

4. We have not started a car replacement fund yet and do not feel we need to move up in car. Our 2 primary autos are a 2005 and 2007. I’m still driving a beater to and from work as well.

Previous Posts:

Dave Ramsey’s Baby Steps - Expanded

Baby Step 0: Live like no one else…

Baby Step 1.0: Save $1,000 in Baby Emergency Fund (BEF)

Baby Step 2.0: Do debt snowball, paying all your debts from lowest BALANCE to highest

Coming Up Next:

Baby Step 4.0: Start contributing 15% of your paycheck to retirement

Dave Ramsey's Expanded Baby Steps - Baby Step 2.0

Posted by Lance | 6:56 AM | Dave Ramsey, Financial Action, Personal finance | 0 comments »Baby Step 2.0: Do debt snowball, paying all your debts from lowest BALANCE to highest

2.1 If your second mortgage or home equity line is less than 50% of your take home pay, include it in the debt snowball; otherwise put it with the house in Step 6.0

2.2 DEBT FREE except the house--you can take your first vacation if you can pay cash for it.

Here are the personal steps we took as we began this journey:

1. Our snowball included a car loan and a second mortgage. We paid the car off in 6 months. We have been working on the second mortgage for 14 months and are about 3 months away from paying that off.

2. We were slackers when it came to this. We had the opportunity to go to Disney in FL with a free place to stay and splitting the gas, groceries for the kitchen, then buying tickets. We caved and went on a vacation while were still snowballing our second mortgage. For our situation it will only make about a month’s difference in the payoff so we aren’t regretting the decision but for some people this is not the case.

3. We cannot wait to call in on the Dave Ramsey Show and shout at the top of our lungs – We’re Debt Free!!!

Some people would disagree with the debt snowball method to paying off debt. I’m a numbers guy, so I understand that this is not mathematically the best way to pay things off, but the bottom line is it WORKS! If you’re interested in other methods of debt reduction check out these two articles from NCN at No Credit Needed:

· Debt Deluge – Modified Debt Snowball

Previous Posts:

Dave Ramsey's Baby Steps - Expanded

Baby Step 0: Live like no one else…

Baby Step 1.0: Save $1,000 in Baby Emergency Fund (BEF)

Coming Up Next:

Baby Step 3.0: Save 3-6 months EXPENSES in Fully Funded Emergency Fund (FFEF)

Larry Burkett's Earthquake - Part 1 The Seeds of Destruction

Posted by Lance | 9:58 PM | Christianity, Crown Financial Ministries, Larry Burkett | 0 comments » Image via Wikipedia

Image via Wikipedia

Larry Burkett's Earthquake – Part 1

Seeds of Destruction

Prior to and during this section of the book Larry is basically giving a history lesson. He describes the economy before, during, and after the Great Depression. He talks about the things our federal government to stimulate the economy and turn things around. In this section he starts laying the groundwork that leads up to his economic earthquake.

Opening quote for this section:

With the best of intentions, America's political leaders paved the way for the destruction of the soundest economy in the world. As Sir Winston Churchill once said, "the road to hell is paved with good intentions."

LRG: Couldn't this statement easily be said today too?

NATIONAL DEBT

It is not new for our government or any other to borrow money. Most governments do so when in a crisis, such as a war. What is unique today is that our government borrows during good time and bad, during war and peace alike. But what makes our government's debt so dangerous is that we are in debt beyond our total asset value. In other words, we are actuarially broke.

Unfortunately, there seems to be no thought of ever trying to repay the debt. In truth, our government cannot even pay the interest on its debt, unless it does so through additional borrowing…

LRG: If we were BROKE in 1991 where does that leave us now?

In order for the government to continue to operate, it must either cut spending, increase revenues [taxes], or find another "fix." I believe it is this other "fix" that represents danger to our economy.

LRG: Could these stimulus packages be the "fix" that Larry warns as dangerous? The stimulus package includes more spending and reduced taxes (for some anyway). Where's the spending going to come from? Are we going to print more money and devalue the dollar? Borrow more money from foreign sources?

CONSUMER DEBT

During the Great Depression it was in the interests of lenders (mostly bankers) to support the American economy. That will not necessarily be the case in the next depression. When push comes to shove (so to speak), the foreign lenders' interests will lie primarily with their own countries and in maintaining jobs for their people. With our government dependent on foreign loans for nearly half of its deficit spending, there is little that could be done to protect the interests of American workers.

LRG: What direction is our unemployment rate going right now?

Americans are living in an inflated economy created by the use of borrowed money. Since the early sixties, virtually all major assets have been purchased on credit. Since the mid-seventies, even consumer goods have been acquired on credit via the use of credit cards and [home] equity loans.

Most American families, in spite of their outward appearance of affluence, live on the brink of economic disaster. They have little or no savings to fall back on in difficult times and now are borrowing against the equity in their homes to buy nonessential goods. If the value of their homes falls during an economic downturn, both the borrowers and the lenders are going to be in real trouble.

LRG: Wow, did this really come from a book written in 1991. It almost takes my breath away.

"If the value of their homes falls" that's exactly what has happened!!!!

"Both the borrowers and the lenders are going to be in real trouble" and boy aren't they in trouble now!!!

Americans are rapidly consuming all their available equity. In essence, they are transferring their wealth to relatively few lenders, who then lend it to the government, who then pays it to foreign investors.

LRG: Yep, that's what's happening alright.

STATE DEBT

Anyone who reads the newspaper or watches the evening news knows that many states are in severe financial trouble. The same abuses that we see at the federal level are evident on a smaller scale at the state (and local) level.

…

Any economy lives or dies on the basis of public confidence. Lose that confidence, and the system crashes.

LRG: Where's your confidence?

WHAT'S NEXT

…those who fail to learn from the past are doomed to repeat it. You'd think that just a little more than six decades after the most severe depression in US history, we would remember the lessons learned: you can't spend more than you make forever and not pay the price, and when the bottom falls out it is the lenders who will be protected, not the borrowers.

LRG: This was in 1991, it's now 2009 and just exactly as Larry said "when the bottom falls out it is the lenders who will be protected, not the borrowers"

Who's getting the bailout…THE LENDERS!! I'm almost speechless, this is from 1991 people. Could these words describe what is happening right now any better, I don't think so.

Are you as blown away as I am? What are your thoughts?

Previous:

Larry Burkett's Earthquake – Intro

Next:

Larry Burkett's Earthquake – Part 2 Examples & Cycles

Programmable Thermostats & CFLs - Do they work? Does it Help?

Posted by Lance | 10:43 AM | Energy conservation, Financial Action, save money | 0 comments »In a prior post, Going Green to Save Money, I outlined our action plan to reduce our electricity usage.

So how did we do and what are the real tangible results… Image by FFL-LRG via Flickr1 – Turn down (way down) the thermostat while on vacation for a week – Did it help? YES

Image by FFL-LRG via Flickr1 – Turn down (way down) the thermostat while on vacation for a week – Did it help? YES

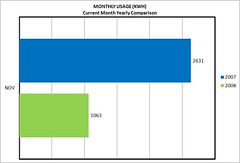

In November we took a family vacation with some friends to Disney for a week. While we were out of town I reduced the temperature on our thermostat to 65o. The results: 60% reduction in our electricity usage, 2631 KWH to 1063 KWH. This is on a year-to-year basis, i.e. Nov ’07 versus Nov ’08. I expected at least a 25% reduction but not 60%. Cost: $FREE

2 – Install a programmable thermostat – Did it help? YES

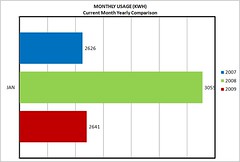

I installed the thermostat in December, but I did so toward the end of the cycle and on top of that I made some errors wiring it up which meant it didn’t wasn’t running as it was intended. Because of that, I have  Image by FFL-LRG via Flickrwaited until January to evaluate the comparison. There are few things to note. The local paper just had a clip mentioning that the electricity usage over the last month hit an all time high on the Friday morning when it reached 5o. While the above November usage may have been helped by warmer temperatures in ’08 over ’07, it is a fact that Jan ’09 was colder than Jan ’08. But all in all, this much colder weather would have only been captured in the last week of the monthly cycle. This means I will need to closely evaluate February as well. So now, the results: 14% reduction over ’08 and a less than 1% increase over ’07. Cost: $99

Image by FFL-LRG via Flickrwaited until January to evaluate the comparison. There are few things to note. The local paper just had a clip mentioning that the electricity usage over the last month hit an all time high on the Friday morning when it reached 5o. While the above November usage may have been helped by warmer temperatures in ’08 over ’07, it is a fact that Jan ’09 was colder than Jan ’08. But all in all, this much colder weather would have only been captured in the last week of the monthly cycle. This means I will need to closely evaluate February as well. So now, the results: 14% reduction over ’08 and a less than 1% increase over ’07. Cost: $99

3 – Turn down the temperature of the electric hot water heater (it was too hot already, not safe with a toddler in the house)

The first time I turned the temperature down I went too far. According to wife. Prior to lowering the temperature, we would have the shower about 50% toward the hot water. After this first adjustment we basically went to 100% open hot water. I re-adjusted the temperature and now we have settled at about 80% toward the hot water. Cost: $FREE

4 – Install a insulated blanket on the hot water heater

We purchased an insulated blanket from Lowes and wrapped around the hot water heater, plus put some scrap insulation on the top. The hot water heater is in the garage, but it did feel warm on the outside to the touch so I felt that the blanket could conserve a small amount of energy. COST: $20

5 – Install a dimmer switch, if possible, for the recessed lighting in our kitchen

It was possible to install a dimmer switch. I don’t’ believe there was much of an impact because it just isn’t practical to dim the light as much as I thought we could. COST: $10

6 – Replace all high usage light bulbs to compact fluorescent light bulbs (CFLs)

Installed 7 CFLs in our most commonly used lamps. I did not replace the lights in the kitchen that I mention above due to the high cost and number of bulbs (8). COST: $15

Total cost of supplies $144.

Savings…well we did see significant reductions in usage, but with an increase in the cost of electricity we really didn’t save much real money. Not yet anyway. Saved $16 in November, but increases made January go up by $26. I would still call this a success due to the usage reduction.

Have you implemented these or other eletricity or green money saving ideas? Any tips you can give?

Dave Ramsey's Expanded Baby Steps - Baby Step 1.0

Posted by Lance | 6:26 AM | Dave Ramsey, Financial Action, Personal finance | 0 comments »Baby Step 1.0: Save $1,000 in Baby Emergency Fund (BEF)

1.1 Shred or cut up ALL CC's. (You have a BEF now, no NEED to keep those CC's !!)

1.2 Get/Evaluate Health insurance NOW

1.3 Get/Evaluate Life insurance NOW

1.4 A Get/Evaluate Long Term Disability (LTD) insurance NOW

1.5 Amputate cars that you can't pay off within 24 months. Buy a safe older vehicle: $2-3k range

1.6 Consider raising insurance deductibles to $500 or $1000 and dropping full coverage on paid for used car

1.7 Draw up a will.

Here are the personal steps we took as we began this journey:

1. We have closed inactive credit card accounts. We still have 2 accounts open, one at our credit union that my wife hasn’t given up yet and one with Discover. We do still use the Discover card for things like gas and online purchases that don’t accept PayPal. We are considering facilitating a FPU class at our church in the next few months, if/when we do, we will cut up both these cards as an example to our class.

2. We started using the Flexible Spending Account offered by our health insurance. This account takes pre-tax contributions and allows you to reimburse yourself throughout the year. The catch with this account is that it’s a use or lose type account. Once we established an expense tracking system along with our budget I was able to develop a plan for how much money to fund the account with. This year our new insurance provider has given us a debit card linked to our FSA which will allow us to use the funds instantly without the delay of filling out forms, submitting, and then waiting for the reimbursement.

3. I then increased the LTD insurance coverage available to me through my employer. My wife works part time only so that is not available with her employer and ultimately not needed.

4. We had bought a new car only a couple of months before we started FPU. But with great intensity we paid that off in 6 months. No car payments!!

5. We did raise our deductibles for both comprehensive and collision. Murphy did strike last year regarding our increase on comprehensive from $0 to $500. We hit a deer and had to have work done on the grill and the hood. But the change in the comprehensive deductible alone saved us $548 per year. So for this case, in our first year, we only saved $48, but everything after that will be gravy, given that we steer clear of the deer going forward.

6. Regarding a will, we are slackers. This is on the To Do List for 2009.

Previous Posts:

Baby Steps - Expanded

Baby Step 0: Live like no one else…

Coming Up Next:

Baby Step 2.0: Do debt snowball, paying all your debts from lowest BALANCE to highest

Larry Burkett's Earthquake - Intro & Background

Posted by Lance | 11:36 AM | Crown Financial Ministries, Financial Action, Larry Burkett, Personal finance | 0 comments »I believe it has already started, but have we made it through yet, I don’t think so. I believe the biggest and most dangerous part is still to come.

Image via WikipediaFor those of you that have not read or heard of Larry Burkett or his book The Coming Economic Earthquake

Image via WikipediaFor those of you that have not read or heard of Larry Burkett or his book The Coming Economic Earthquake

let me provide a brief back ground. Larry founded a ministry called Christian Financial Concepts (CFC), a nonprofit organization dedicated to teaching the biblical principles of handling money. In September 2000, CFC merged with Crown Ministries, creating a new organization, Crown Financial Ministries. Burkett served as Chairman of the Board of Directors until his death. In 1991, he wrote the book The Coming Economic Earthquake, which warned that Keynesian economic policies, with ideals for continuing federal deficits and the implicit preference for higher levels of consumption, reduced saving, and a larger role for government in the economy are a means to disaster. Burkett questioned whether or not elected leaders would take action in time to prevent fiscal chaos, and believed they would not. His “predictions” focused on the year 2000 as the turning point and when that time came and went most dismissed his book and its information as false and irrational doom and gloom.

What is most interesting to me is how his presentation of the facts and the predictions he made in the book are relevant today and what I can learn from them. As I wade through the book, I plan to present pertinent information in the form of short quotes or brief passages share my thoughts on how they pertain to today’s circumstances.

I must convey that I do not have any financial background and that my views are based solely on my experiences. So please add your comments and opinions and feel free to correct me if I’m heading off in the wrong direction and I attempt to apply Larry’s information from 1991 to 2009’s reality.

I’ll leave you with a quote from the insider cover of the book:

If I’m wrong, anyone who follows the directions in this book will be better off financially. If I’m right, they will be among the few to prosper in what may well be the greatest economic calamity of the millennium. (emphasis is Larry’s)

Next:

Larry Burkett’s Earthquake – Part 1 Seeds of Destruction

Dave Ramsey's Expanded Baby Steps - Baby Step 0

Posted by Lance | 6:07 AM | Dave Ramsey, Financial Action, Personal finance | 0 comments » Image by Tarable1 via Flickr

Image by Tarable1 via Flickr

Baby Step 0:

Live like no one else…0.1 Commit to NO DEBT EVER AGAIN. (mortgage is possible exception)

0.2 Talk with spouse and get him/her on the same page as you concerning finances.

0.3 Do a written budget.

0.4 Temporarily stop all retirement contributions.

0.5 Get current on all the basics (You MUST have Food, Utilities, Shelter, Basic Transportation).

0.6 Amputate "toys" (bikes, boats, ATV's etc) if your snowball will take more than 12 months

0.7 Cut lifestyle (Cut cable, cell phone, landline extras, internet, eating out, etc)

0.8 A Get a 2nd job if Baby Emergency Fund ($1,000) will take more than 30-90 days.

0.9 Get current on ALL bills.

Here are the specific personal steps I took as I began this journey:

1. Track every expense; every penny has to go somewhere. Use the history from your bank statements, electronically, to generate a starting reference point. I created an Excel spreadsheet to handle this.

2. Start using a cash envelope system for certain expenses. Allocate less cash than you were spending when you review your expense tracking. The categories we settled on for the envelopes are:

a. Food

b. Spending Money – His/Her Blow Money

c. Lawn & Garden

d. Yard Sale

e. Clothing – Adult & Children

f. Date Night

3. Work up a written budget. A spending plan before the month begins. Allocate every dollar of income to a category of your budget. We used the expense tracking as the starting point and just changed our view from a historical rear view to a forward looking planning view.

a. Take care of necessities first: minimal food, shelter, necessary utilities, transportation, basic clothing – no frills, no luxuries

b. Minimum payments on all debts. Set up electronic payment everywhere possible.

c. Then look at optional utilities/services: cable/satellite, phone services, internet service

d. Next look at personal wants and pleasures

e. TRIM THE FAT – immediately remove or reduce the obvious

f. Add that money to your minimum payment on the smallest debt, using a debt snowball approach. This will be discussed later in detail.

Previous Posts:

Baby Steps - Expanded

Coming Up Next:

Baby Step 1.0: Save $1,000 in Baby Emergency Fund (BEF)

Image via Wikipedia

Image via Wikipedia

Isaiah 45:4-7

4b I call you by your name,

I name you, though you do not know me.

5 I am the Lord, and there is no other,

besides me there is no God;

I equip you, though you do not know me,

6 that people may know, from the rising of the sun

and from the west, that there is none besides me;

I am the Lord, and there is no other.

7 I form light and create darkness,

I make well-being and create calamity,

I am the Lord, who does all these things.

(ESV)

Dave Ramsey's Baby Steps - Expanded

Posted by Lance | 5:21 AM | Dave Ramsey, Financial Action, Personal finance | 0 comments »A lot of people are familiar with Dave Ramsey and his Baby Steps. Especially those reading personal finance blogs. Some people have also read his books and visited his website, and may have even went through Financial Peace University. But other than those individuals, there are even more people who have never read the books, may or may not know the baby steps, and really overall don’t have a clue what they are. Even if you do know what they are, you may not have a good idea of where to get started and what exactly each step includes and how to achieve the end result of each step.

Over the next several articles, I will dive in and present Expanded Baby Steps. I will lay out the ground work for each step and give you our personal experiences and the specific steps that we went through on the journey to getting out of debt.

First let’s look at Dave’s list of Baby Steps:

1 – Starter Emergency Fund - $1,000

2 – Debt Snowball

3 – Fully Funded Emergency Fund – 3 to 6 Months Expenses

4 – Invest 15% in Retirement

5 – College Funding

6 – Pay-off Home Early

7 – Build Wealth & Give

Here’s a link to Dave’s pdf version.

Stay Tuned for…

Baby Step 0: Live like no one else…

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=daa7ebd2-09c3-4cff-8858-25f7eb846d44)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=34f9a8fe-dbf3-41ab-868d-ce7617d0c36c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=10bc715f-4c27-4f74-bf39-3dfa81b543ba)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=39c1b4d3-4b02-4f44-b7e6-8d2de7466420)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=c7f03ebf-0625-48f8-b78a-ab6bd585c86c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=e91c2592-a255-477b-93b9-02d8c7986886)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=1b211dd5-4403-48b9-9220-b4cda36afff1)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=3346bc24-66d5-455d-abff-97bf32df9eac)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=ee78bd85-b257-4e59-914f-33e857f33649)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=fead89af-c6e0-4fd3-ae3a-206e5b195ea4)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=0f478802-f62c-419e-afd5-c18ac95b39a8)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=55244a3e-4e34-47a3-839f-92ccc6be0c8e)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=e1caff37-6794-4c38-a187-336db3dbb0b8)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=d555c2c6-ccd4-49fd-9ba6-718e6aabca04)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=0af00d1a-b494-46b5-b3a8-3cbc7308af40)