Larry Burkett's Earthquake – Part 2

The first example is Germany in 1918:

When the German government made the decision to print the money it needed, it was hailed by progressive economists as an enlightened move. The "enlightened" philosophy was that currency should not be linked to precious metals anyway, since it allowed for no direct government control over the economy. This philosophy would eventually resurface in America during the "New Deal."

…

To compensate for the lack of currency, the Reichsbank (the German equivalent of our Federal Reserve) authorized the printing of more currency. This would prove to be the downfall of the German economy and, ultimately, the Republic. As I commented previously, when any government makes the decision to inflate its economy through debt, eventually it will be faced with more difficult decisions about how to repay that debt. As long as the debt is held by its own people, the solutions are somewhat easier because it is in their interests to maintain the system. When the debt is held by foreigners, however, there is no choice but to either pay up or risk losing the ability to trade with other nations. Inevitably the government is faced with three basic choices: default, raise taxes, to inflate the currency.

…

Once hyperinflation struck Germany, bank loans were indexed to the currency devaluation. But since wages were not indexed, the loans escalated far beyond the average worker's ability to repay them. Most average-income workers lost everything they owned. This massive shift of wealth would later pave the way for the National Socialist Party (Nazis) to grasp power. The wealthy got wealthier, and the middle class got wiped out.

…

The deutschemark became worthless. Lifetimes of savings were wiped out, and the only form of trade for most Germans was barter.

…

The net result of hyperinflation was the dissolution of the German government. After the collapse of the economy, Germans turned to socialism, believing that the free-enterprise system had failed them. When the depression of 1929 struck, Germany still had not recovered from the devastating effects of the earlier collapse.

The second example was Argentina in 1940:

In 1940 Argentina was one of the world's fastest developing countries. The example of Argentina is what not to do to an economy. The Argentine leaders were greatly influenced by American economists who followed the theory know as Keynesian Economics. To refresh your memory, this is the philosophy that the central government should control the economy for the "good" of the workers. To implement Keynesian economics requires both a strong central monetary system, such as the Federal Reserve, and the ability to inflate the currency when necessary.

…

By 1980 their debt was $44 billion – nearly matching their GNP and requiring half of the government's income just to service the interest on the debt. … The Argentine government was faced with three choices: default, raise taxes, or inflate the currency.

…

If Argentina had simply defaulted on its debt, virtually all access to any additional loans would have been cut off. The second option of tax increases (and spending cutbacks) would seem the most logical approach. After all, that's what is expected of individuals when they overspend their own budgets, isn't it? But Argentina already had a tax rate of 40 percent and a government that was spending money faster than the people could make it. Instead, the Argentine government, just as the Germans did some sixty years earlier, opted for the easy way out and began to inflate its currency. Simply put, they printed the money they needed.

…

The government estimated that inflation would increase about 20 percent as a result of their actions. Instead it rose by nearly 700 percent! The middle class in Argentina was rapidly being wiped out. Retirees, pensioners, and those living on fixed incomes were destitute in less than a month.

…

By January of 1990 the annualized inflation rate was about 5,600 percent. Prices tripled while Argentineans slept.

…

In an effort to gain at least some degree of control over inflation, the government (at the insistence of the World Bank) established the equivalent of martial law over the economy. The currency was frozen and the printing of any new money was forbidden; wages and prices were frozen; black marketing was punishable by long prison sentences; and so on. This helped to establish some semblance of sanity in an insane system, and by early 1991 inflation was reduced to a mere 300 percent per year.

I see three clear cut issues from what Burkett describes in both of these prior examples.

- There were 3 choices as a result of debt: default, increase taxes, print more money (inflate the currency).

- Both chose to print more money which led to hyperinflation.

- The middle class suffered the most, virtually wiped out. This pointed the nation toward socialism.

See this post on Christian Personal Finance: Is the Fed running the U.S. economy into the ground? If this doesn't alarm you, it should.

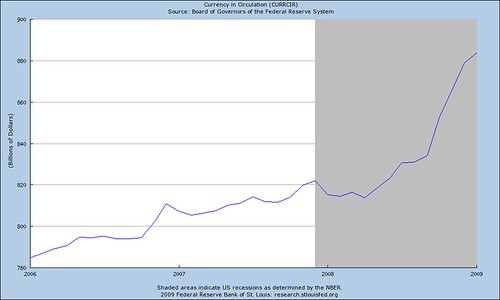

Here is the graph of the amount of currency in circulation from the Federal Reserve:

As you can see from the graph, the Fed has greatly increased the amount of currency in circulation during this current recession.

What is our current National Debt? 10.7 TRILLION DOLLARS

With an average interest rate of 3.811%, (link here) the annual interest is 408 BILLION DOLLARS!!

With an average interest rate of 3.811%, (link here) the annual interest is 408 BILLION DOLLARS!!Our Gross Domestic Product was $14.3 trillion as of Oct 2008 (link here).

Previous:

Intro & Background

Part 1 – Seeds of Destruction

Next:

Part 3 – Economic Cycles

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=9d00da55-b2f8-4839-933e-19a2dbb60c87)

0 comments

Post a Comment