Part 1 – Using Your Explanation of Benefits (EOB)

The first place to start is to thoroughly examine your history. Start with the previous year if available and/or the current year-to-date.

I created a spreadsheet (go figure) to list everything out for myself, my spouse, and my son.

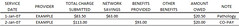

Here is an example screenshot from my spreadsheet:  Image by FFL-LRG via Flickr

Image by FFL-LRG via Flickr

The biggest thing to keep in mind when doing this is that you must recognize and document all the co-pays separate from everything else that is applicable to the co-insurance or deductible.

Just for clarifications sake. A co-pay is a set amount you pay for certain “normal” medical expenses such as a doctor visits. For example under our current plan, each doctors visit, or each time we take our son for his 3 month, 6 month, 12month check-ups it will cost us $20 in a co-pay. While co-insurance is the coverage for other medical expenses after you meet you deductible and is comprised of two percentages. One is the percent that the insurance pays and the other is the percent that you pay (totally 100%). For example if we take my son to the doctor because we think he is sick and the doctor orders a special lab analysis then the lab costs will be covered by the co-insurance. Take a look at the first line in the above screenshot, the pathology had a total charge of $83.50 and because this was an in-network provider there were $63 in network savings leaving $20.50. If we had already meet the individual or family deductible we would have only paid 30% of the cost or $6.15 and the co-insurance would have paid for $14.35. I hope this make sense, of not leave a question in a comment and I will respond as quickly as possible.

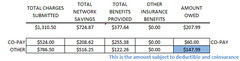

Once you have listed all your medical expenses using your EOBs. Then you need to add everything up and summarize, keeping the co-pay separate from everything else. Here is an example of the summary from my spreadsheet: Image by FFL-LRG via Flickr

Image by FFL-LRG via Flickr

Click on the images to see a larger image I have put on Flickr.

0 comments

Post a Comment