24 Hour News 8's Suzanne Geha talked with him prior to the event.

24 Hour News 8's Suzanne Geha talked with him prior to the event.

Check this out: 16-page introduction of I Will Teach You To Be Rich book

A new mortgage rescue plan is in the works. This plan would especially focus on the mortgages in and/or heading into foreclosure. Will this be enough to boost the housing market? I don't know, but I do think that until the Fed gets into the Mortgage Backed Securities market, resulting in pushing interest rates down, the housing market will basically be stalled. I've been floating on my refinance hoping that the rates would drop back down to the 5% and below levels. I'm leaning toward going forward, stop the waiting and just get on with it.

Stimulus Package Housing Impact

Posted by Lance | 1:26 PM | Economic Stimulus, Financial Action, Tax credit | 0 comments »from Tyler Osby:

What The New Stimulus Package Means to Housing

For First Time Homebuyers

The first provision is fairly well-known. It gives first-time home buyers an $8,000 tax credit provided they purchase a home between January 1, 2009 and August 31, 2009.

This is a true tax credit.

The $8,000 credit requires home buyers to hold property for at least 3 years. If the home is sold in fewer than 3 years, the tax credit must be repaid to the government. Bummer.

It’s also worth noting that the date range applies closings and not sales agreements.

Closings must occur within these 8 months to be eligible.

Posted using ShareThis

These banks will have an insatiable appetite for funds and, like all zombies, will try to eat our brains. From the looks of what's coming out of Washington, maybe they already have.

Posted Feb 11, 2009 11:26am EST by Aaron Task

Stimulus, Spendulus...Not Stimulating

Posted by Lance | 1:22 PM | DJIA, Financial Action | 0 comments »The senate passes the stimulus bill and the dow drops more than 300 pts (4+%).

I'm not very confident that this "stimulus" will actually stimulate anything.![]() RSS Feed

RSS Feed ![]() Email Subscription

Email Subscription

Examples to Learn From

Posted by Lance | 5:30 AM | Financial Action, Larry Burkett, Personal finance | 0 comments »Larry Burkett's Earthquake – Part 2

The first example is Germany in 1918:

When the German government made the decision to print the money it needed, it was hailed by progressive economists as an enlightened move. The "enlightened" philosophy was that currency should not be linked to precious metals anyway, since it allowed for no direct government control over the economy. This philosophy would eventually resurface in America during the "New Deal."

…

To compensate for the lack of currency, the Reichsbank (the German equivalent of our Federal Reserve) authorized the printing of more currency. This would prove to be the downfall of the German economy and, ultimately, the Republic. As I commented previously, when any government makes the decision to inflate its economy through debt, eventually it will be faced with more difficult decisions about how to repay that debt. As long as the debt is held by its own people, the solutions are somewhat easier because it is in their interests to maintain the system. When the debt is held by foreigners, however, there is no choice but to either pay up or risk losing the ability to trade with other nations. Inevitably the government is faced with three basic choices: default, raise taxes, to inflate the currency.

…

Once hyperinflation struck Germany, bank loans were indexed to the currency devaluation. But since wages were not indexed, the loans escalated far beyond the average worker's ability to repay them. Most average-income workers lost everything they owned. This massive shift of wealth would later pave the way for the National Socialist Party (Nazis) to grasp power. The wealthy got wealthier, and the middle class got wiped out.

…

The deutschemark became worthless. Lifetimes of savings were wiped out, and the only form of trade for most Germans was barter.

…

The net result of hyperinflation was the dissolution of the German government. After the collapse of the economy, Germans turned to socialism, believing that the free-enterprise system had failed them. When the depression of 1929 struck, Germany still had not recovered from the devastating effects of the earlier collapse.

The second example was Argentina in 1940:

In 1940 Argentina was one of the world's fastest developing countries. The example of Argentina is what not to do to an economy. The Argentine leaders were greatly influenced by American economists who followed the theory know as Keynesian Economics. To refresh your memory, this is the philosophy that the central government should control the economy for the "good" of the workers. To implement Keynesian economics requires both a strong central monetary system, such as the Federal Reserve, and the ability to inflate the currency when necessary.

…

By 1980 their debt was $44 billion – nearly matching their GNP and requiring half of the government's income just to service the interest on the debt. … The Argentine government was faced with three choices: default, raise taxes, or inflate the currency.

…

If Argentina had simply defaulted on its debt, virtually all access to any additional loans would have been cut off. The second option of tax increases (and spending cutbacks) would seem the most logical approach. After all, that's what is expected of individuals when they overspend their own budgets, isn't it? But Argentina already had a tax rate of 40 percent and a government that was spending money faster than the people could make it. Instead, the Argentine government, just as the Germans did some sixty years earlier, opted for the easy way out and began to inflate its currency. Simply put, they printed the money they needed.

…

The government estimated that inflation would increase about 20 percent as a result of their actions. Instead it rose by nearly 700 percent! The middle class in Argentina was rapidly being wiped out. Retirees, pensioners, and those living on fixed incomes were destitute in less than a month.

…

By January of 1990 the annualized inflation rate was about 5,600 percent. Prices tripled while Argentineans slept.

…

In an effort to gain at least some degree of control over inflation, the government (at the insistence of the World Bank) established the equivalent of martial law over the economy. The currency was frozen and the printing of any new money was forbidden; wages and prices were frozen; black marketing was punishable by long prison sentences; and so on. This helped to establish some semblance of sanity in an insane system, and by early 1991 inflation was reduced to a mere 300 percent per year.

I see three clear cut issues from what Burkett describes in both of these prior examples.

- There were 3 choices as a result of debt: default, increase taxes, print more money (inflate the currency).

- Both chose to print more money which led to hyperinflation.

- The middle class suffered the most, virtually wiped out. This pointed the nation toward socialism.

See this post on Christian Personal Finance: Is the Fed running the U.S. economy into the ground? If this doesn't alarm you, it should.

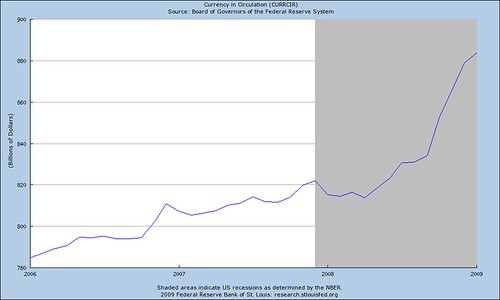

Here is the graph of the amount of currency in circulation from the Federal Reserve:

As you can see from the graph, the Fed has greatly increased the amount of currency in circulation during this current recession.

What is our current National Debt? 10.7 TRILLION DOLLARS

With an average interest rate of 3.811%, (link here) the annual interest is 408 BILLION DOLLARS!!

With an average interest rate of 3.811%, (link here) the annual interest is 408 BILLION DOLLARS!!Our Gross Domestic Product was $14.3 trillion as of Oct 2008 (link here).

Previous:

Intro & Background

Part 1 – Seeds of Destruction

Next:

Part 3 – Economic Cycles

Thinking about buying a home in 2009?

Posted by Lance | 8:42 PM | $15 000 Homebuyer Tax Credit, $15000 Homebuyers Tax Credit, 2009 Economic Stimulus Package | 0 comments »There was an earlier version of the tax credit in 2008 as well. Confused yet about the 2008 tax credit and the proposed 2009 tax credit? Click on the links above to read the 2009 Economic Stimulus Package and the $15,000 Homebuyers Tax Credit – All the answers to your questions from the Investing Blog. This post is a good outline of the differences and will be kept it up to date as things progress through congress. So be sure and check back often as the package goes to vote in both houses of congress and then across the president's desk.

From the site:

What Does the So-Called “Stimulus Package” Mean For You?

It means you pay.

You pay for more bailouts, more giveaways, more wasteful

spending...and your children and grandchildren pay for trillions of dollars of

debt.

But you can fight back right now. By signing the petition, you can

join the thousands of Americans who are saying NO!

Keep up with everything Financial - Family - Life:

Giving Myself a Raise!

Posted by Lance | 11:55 AM | Financial Action, Income tax, Personal finance | 0 comments »It's tax time again and one thing that came to my attention this year is the number allowance that I claim on my W-4 form with my employer. Form W-4 is completed so that your employer can withhold the correct federal income tax from your pay. You should consider evaluating your W-4 allowances each year as you financial situation changes. To complete the W-4 Form, you specify marital status, and the number of exemptions or allowances you wish to claim. As the number of exemptions you claim increases, the amount of tax withheld decreases, and vice versa. You also have the option of specifying additional flat dollar amounts to be withheld. Here are the boxes on the form: Box 1: Name If you tax return for 2008 is greater than $500, I would suggest evaluating and possibly increasing the number of allowance you claim on your W-4. This can be change any time. Each employer will have a different way of making the changes though so check with your payroll or human resources department. My employer gives us online access to submit changes to our W-4 forms and it will take effect on the next pay period which is nice. For tax year 2007 our tax refund was more than $5,000 so I increased my allowances from 1 to 2. This was not nearly enough. This year (tax year 2008) our refund is more than $2,500. My employer provided some tables and a worksheet in order to make better decisions on the number of allowances you should claim. I also used a calculator from the IRS to evaluate my allowances. Using both came out with the same results. They indicated that I should be claiming 6 allowances and would still get an estimated return around $500. So I dug a little farther and using details provided by my employer I was able to look at all my options. What I determined was that each additional allowance would knock $21 off the amount of taxes I was paying each pay period. So then divide $2,500 by 26 pay periods, is $96, then divided by $21 gives me 4.5 additional allowances I could claim to reduce the amount of taxes taken from my pay and therefore reduce the amount of money I was giving the government as an interest free loan. 4.5 plus the original 2 allowances equals 6.5, but since it has to be a whole number, I will settle on 6 allowances. This will increase my wages by $84 per pay period or $168 per month! Talk about a raise! My employer said "no pay raises this year", well I'll just give myself a raise. I'd rather get $168 more per month than one lump sum in March or April. I've learned that I can do more with my money than the government can anyway. All they would do is SPEND it on something I don't agree with. I need to build up my emergency fund, add to my kids college fund, increase my retirement, pay off my house early…I can think of far better ways to use my money than loan it to the government interest free! To evaluate your allowances and give yourself a raise, use the IRS Withholding Calculator. Other resources you may find helpful are:  Image via Wikipedia

Image via Wikipedia

Box2: SSN

Box3: Marital Status

Box4: Checkbox for name differences

Box5: Number of Allowance

Box6: Additional Amount $, per paycheck

Box 7: Exemption Status

Box8: Employer's Name

Box9: Office Code

Box10: EIN

IRS Form W-4 Worksheet (pdf)

IRS Publication 919 How Do I Adjust My Tax Withholding? (pdf)

Dave Ramsey’s Baby Steps – Expanded (Summary)

Posted by Lance | 6:43 AM | Baby Steps, Dave Ramsey, Financial Action, Personal finance | 0 comments »Over the last couple of weeks I have went through Dave Ramsey's Baby Steps expanding out the smaller sub-steps of each one. In case you missed one of the steps or you are just getting here, below are links to each of the Expanded Baby Steps. I hope you have or will read through each step and leave comments if you have any questions, ideas, or opinions. There is actually one more step that I will be going over soon. It's not part of Dave's steps but it will be one of my financial priorities: TRUE FINANCIAL FREEDOM This one might take a lifetime, but it is a worthy goal and one I plan to pursue whole heartedly.

Dave Ramsey's Baby Steps - Expanded

Baby Step 0: Live like no one else…

Baby Step 1.0:Save $1,000 in Baby Emergency Fund (BEF)

Baby Step 2.0: Do debt snowball, paying all your debts from lowest BALANCE to highest

Baby Step 3.0: Save 3-6 months EXPENSES in a Fully Funded Emergency Fund (FFEF)

Baby Step 4.0: Start Contributing 15% of you paycheck to retirement

Baby Step 5.0: Save for kids college fund

Baby Step 6.0: Pay off house EARLY

Baby Step 7.0: Build Wealth & Give - … so now you can live like no one else!!

Dave Ramsey's Expanded Baby Steps - Baby Step 7.0

Posted by Lance | 9:17 AM | Dave Ramsey, Financial Action, Personal finance | 0 comments »Baby Step 7.0: Build Wealth & Give - … so now you can live like no one else!! 7.1 Giving over and above tithe. 7.2 Investing in paid for real estate and mutual funds. 7.3 Lifestyle and luxury increases. 7.4 Inheritance – Change your family tree. Our future plan: Missed a step? Here are all the previous posts from this series:

Dave Ramsey's Baby Steps - Expanded

Baby Step 0: Live like no one else…

Baby Step 1.0:Save $1,000 in Baby Emergency Fund (BEF)

Baby Step 2.0: Do debt snowball, paying all your debts from lowest BALANCE to highest

Baby Step 3.0: Save 3-6 months EXPENSES in a Fully Funded Emergency Fund (FFEF)

Baby Step 4.0: Start Contributing 15% of you paycheck to retirement

Baby Step 5.0: Save for kids college fund

Baby Step 6.0: Pay off house EARLY

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=3229b064-9228-4156-b2ec-eac5a18ec9e8)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=9d00da55-b2f8-4839-933e-19a2dbb60c87)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=65dbca59-27e0-42e9-a6e3-1fd65c6c035d)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=57044a04-e932-4e77-87f2-dcb0d91800fa)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=7cab02d6-1366-431e-8c0f-dd8f1da516fd)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_c.png?x-id=439e633c-192e-4fe8-8532-8763742d6aee)